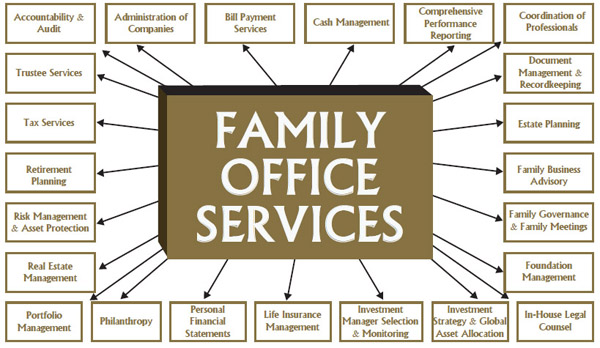

Successful wealth managers offer a wide range of investment services to their clients. Some common services include advising on which investments are best for the client’s goals, managing portfolios, and providing counsel on estate planning. Family office investment adviser typically has a degree in finance, business administration, or accounting and many have years of experience in the investment industry.

There are many different types of investment services that wealth managers offer their clients.

Some wealth managers focus on providing general investing services such as managing a client’s assets in a diversified manner, while others specialize in providing specific types of investments such as stocks, bonds, mutual funds, or a closed end interval fund.

A successful wealth manager will have a wide range of knowledge and expertise in both financial planning and investing. Knowledge of asset classes, risk management techniques and market analysis are all essential components of being a successful wealth manager. Additionally, a good wealth manager will have strong interpersonal skills and be able to build relationships with their clients for the long term.

Some people think that wealth management is all about buying and selling stocks, bonds and other investments. While this is an important part of the job, it’s not the only thing a wealth manager does. Wealth managers can also help clients make smart choices about spending, saving and investing their money.

Here are four different types of investment services that a wealth manager might offer:

1. Financial planning

A wealth manager can help you take care of your finances by providing guidance on creating and sticking to a financial plan. This might include advice on how to save for retirement, invest for growth or cover expenses in case of an emergency.

2. Asset management

A wealth manager can help you find and invest in quality assets such as stocks, bonds and real estate. This can allow you to grow your money over time while protecting it from risks like market fluctuations.

3. Tax planning

A wealth manager can help you understand your income tax obligations and make sure you’re taking advantage of all the tax breaks available to you. This might include filing taxes on time, drafting effective tax shelters or working with a tax advisor to ensure you’re getting the most out of your deductions.

4. Business

A wealth manager is someone who helps people make the most of their money. Wealth managers can offer a variety of investment services, including stock picking, portfolio management, and financial planning. Here’s a look at some of the different types of services that a wealth manager might offer:

Stock picking: A wealth manager might help you pick stocks that are likely to do well over the long term.

Portfolio management: A wealth manager can help you create a balanced and diversified investment portfolio that will maximize your returns.

Financial planning: A wealth manager can help you manage your finances so that you have enough money to cover your expenses and save for retirement.