Investing in the stock market can be risky, as the value of individual stocks can be affected by various factors. However, investing in a fund on EconomyPair can spread your risk across a diversified portfolio of stocks, bonds, and other assets. This can reduce the overall volatility of your investment and increase your chances of earning a positive return. Learn more in this EconomyPair review.

Professional Management

A team of professional investors manages EconomyPair with the expertise and experience to make informed investment decisions. This means that you can spend time on something other than researching and analyzing individual stocks, bonds, and other assets. Instead, you can rely on the expertise of the fund’s managers to make the best investment decisions for you.

Low Costs

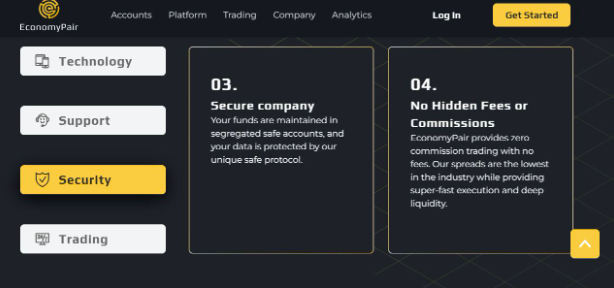

Investing in Forex funds on EconomyPair can be more cost-effective than investing in individual stocks or bonds. This is because the fund’s managers can use economies of scale to keep costs low. Additionally, because the platform helps you trade, you don’t have to pay for expensive research or analysis services.

Liquidity

Investing in a Forex market via EconomyPair can be more liquid than investing using other apps. This means that you can buy or sell shares of the fund quickly and easily without worrying about the illiquidity of the underlying assets.

Consistent Returns

EconomyPair has a history of consistent returns over time. Investing in a fund with a long-term track record of success can increase your chances of earning a positive return on your investment. Additionally, because the fund is diversified and professionally managed, you can be confident that your investment is in good hands, even during market volatility.

Access to a Wide Range of Assets

Investing on EconomyPair gives you access to a wide range of assets you might not be able to invest in individually. For example, the fund may invest in stocks, bonds, real estate, commodities, and other asset classes. This can provide you with a more diverse and well-rounded investment portfolio.

Risk Management

EconomyPair has a risk management strategy to mitigate the potential losses from market volatility. The platform uses a combination of diversification, hedging, and other risk management techniques to help minimize the fund’s exposure to risk.

Tax-Efficiency

EconomyPair can also be more tax-efficient than investing. This is because the fund’s managers can take advantage of tax-loss harvesting and other strategies to help minimize the fund’s tax liability.

Automatic Rebalancing

EconomyPair balances the fund’s portfolio to maintain the target asset allocation. If an asset class becomes overweighted or underweighted, the fund will automatically sell or buy the necessary assets to maintain the target allocation. This helps keep the fund’s portfolio aligned with the investment objectives and reduce risk.

Convenience

EconomyPair is a convenient way to trade. You can invest online with a few clicks, and you can check the value of your investment and make changes to your portfolio at any time. Additionally, because the fund is professionally managed, you can spend less time researching and analyzing individual stocks, bonds, and other assets.