The management of your finances can be a difficult job. Numerous factors are involved the equation, such as taxes, bills and special charges. It is crucial to think about all of them when creating a financial plan to ensure you have your earnings and assets under control and ensure you’re not in cash-flow problems.

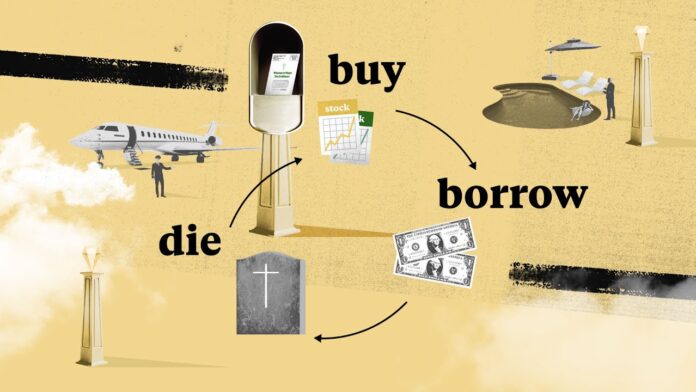

Another strategy is getting more attention in the same way. People are beginning to be interested in the Buy Borrow Die Strategy.

Continue reading this article to learn more about this technique which is attracting the attention of users throughout regions like the United States, the United Kingdom and various other countries.

What is the Buy, Borrow, Die Strategy?

This strategy is aimed at reducing the disparity in wealth between the rich and the rest of the world. This strategy explains why rich individuals continue to increase their wealth while ordinary people struggle to remain at the same level.

Experts consider it to be an effective method used by wealthy individuals to stay out of tax and enjoy an extravagant and luxurious lifestyle. Because of this, many people are becoming very attracted to this method.

The Buy Strategy Borrow Die

We’ll take a closer look at the components and aspects of this strategy for finance that’s getting more interest. We’re not supporting this approach and we’re just providing information regarding the subject.

- BuyThe initial word of the Buy, Borrow, Die strategy is “Buy.” As the name implies, it involves the purchase of assets. A commodity is one that’s value continues to increase as time passes. A property could include stocks, real estate or businesses, for example. It must have significant value in order to receive greater return. This is the place an area that ordinary people have difficulty.

- The BorrowThe other aspect in Buy strategy”Borrow Die” is to borrow. When borrowing, the borrower is required to take out loans from institutions like banks. Selling the asset you purchased to earn cash isn’t an best option since you’ll need to pay taxes on this one. It is better to get a loan, and use the asset as collateral. There are no tax implications on loans, and larger loans come with lower interest rates. This prevents individuals from being required to pay taxes.

- DieThe second aspect is quite difficult. Anyone following an buy Strategy Borrow Die will not be able to see the finalization. This method works because there is no tax on the assets of the individual are handed over to their heirs at the time of their death. The person will be able to keep his assets within his family and not pay any taxes.

The Final Verdict

A financial strategy is beginning to gain momentum, and we’ve listed all the information mentioned below. We don’t advise or promote this strategy , and we only provide details on the similar. The users are encouraged to take decisions according to their own opinions.