The Forex market is fundamentally dependent on liquidity suppliers. Without them, prices would fluctuate erratically as liquidity dried up. What LPs are and how they function in the Forex market will be discussed in this post. We’ll also look at the advantages they offer to traders and brokers. So let’s get started without further ado!

A Liquidity Provider Is What?

A liquidity provider is, in the most straightforward sense, a company that offers liquidity to the forex market. They accomplish this by serving as a counterparty to trades and putting up their own money to guarantee that trades are completed. To decide when and how to offer liquidity, LPs frequently employ complex algorithms. This guarantees that they can deliver it successfully and efficiently.

LPs are essential to the Forex market. It would be difficult for traders to fulfill their trades without them. This is due to the absence of a buyer for the opposite side of the exchange. This would make it very challenging to get any financial advantage on the forex market.

What Is The Mechanism for Liquidity Providers in The Forex Market?

Banks and other financial organizations that offer to purchase and sell currencies on the Forex market are known as LPs. By doing this, a service is offered that enables market participants to conduct transactions without stressing out about finding a buyer or seller for their money.

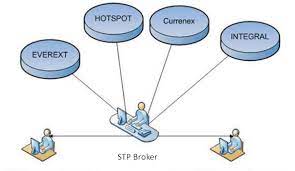

LPs often deliver their services through a network of dealers or brokers, giving market participants ease and choice. These dealers and brokers then give quotes for the rates at which they are prepared to purchase or sell currencies. The decision to accept or reject these pricing is then up to the market participants.

They guarantee that there is always a buyer or seller of a currency at a specific price. By doing this, the market is certain to run smoothly and deals are carried out swiftly and effectively.

What Pluses Are There?

The advantages of employing Forex liquidity services include ensuring that the market can operate without interruption and that deals can be completed swiftly and effectively.

Utilizing a provider also offers protection against price changes that could occur during times of low liquidity. For instance, if a currency’s value suddenly drops, a liquidity provider may be able to step in and buy the currency at its present rate, aiding in market stabilization.

They can also assist market participants in risk management, which is another plus. Consider a scenario when a trader has a sizable stake in a certain currency. If the value of that currency were to abruptly fall, they may be exposed to a sizable amount of danger. But if they already have an LP in place, they might be able to purchase the currency at the going rate and lessen the losses the market participant would suffer.

What Dangers Exist?

Utilizing a liquidity provider has the primary risk that they might not always be able to intervene and supply liquidity when necessary. For market investors holding positions in currencies that see abrupt and severe price changes, this might be problematic.

They might also charge for their services, which is another danger. These charges may reduce market players’ earnings or raise the cost of trading.

Finally, it is crucial to keep in mind that LPs are not perfect. They are capable of making errors and are vulnerable to the same dangers as other market participants. As a result, there is always a chance that an LP won’t be able to deliver the standard of service.

How Do They Generate Income?

By supplying the market with liquidity, LPs profit. They accomplish this by choosing the other side of the deal, thus betting against the trader. If the trade goes against the trader, the LP will profit. The LP will incur losses if the trade is in the trader’s favor.

LPs generally generate revenue by requesting a little payment for their services. The spread is the name of this charge. The spread is the gap between an LP’s willingness to purchase a currency and their willingness to sell it.

Providers that offer a spread of 0.0010 indicate that they are prepared to purchase euros at 1.2490 US dollars and sell them for 1.2510 US dollars. The spread is the variation in these two prices (0.0010 US dollars). One euro is worth 1.25 US dollars, for instance, if the EUR/USD exchange rate is 1.25.

Some LPs may impose a commission in addition to the spread. This is a charge for each transaction. A supplier may charge $2 for each $1,000 in trades if their commission is 0.2%, for instance.

What Various Categories of Liquidity Suppliers Exist?

Banks and non-banks are the two primary categories of Forex liquidity solutions. Banks have long been a source of liquidity for the foreign currency market and are the classic form of LP. Hedge funds and other financial firms, which are not banks, have just recently started to participate in the market.

Banks

The typical LP in the foreign exchange market is a bank. They are often the biggest and most seasoned participants and have been supplying liquidity to the market for many years.

The major advantage of banks is that they have a large amount of money to invest, which enables them to give the market a lot of liquidity. Additionally, banks frequently employ a sizable workforce that are only focused on supplying liquidity. They may therefore offer market coverage that is available around-the-clock.

The biggest disadvantage of banks is that they could not be as risk-averse as non-banks. This implies that they might not be able to offer as much liquidity when the market is under pressure. Banks may also charge more for their services than non-banks.

Non-banks

Hedge funds and other financial firms, which are not banks, have just recently started to participate in the market. The major advantage of non-banks is that they are frequently more risk-taking than banks. This implies that during periods of market stress, they might increase the market’s liquidity. Non-banks may also charge less for their services than banks do.

Non-banks’ primary flaw is that they frequently have less capital than banks. This suggests that they might not be able to give the market as much liquidity. Non-banks can also lack the same degree of expertise as banks and be unable to offer round-the-clock market coverage.

What Kind of Liquidity Provider Is The Ideal One?

This question lacks a definite response. Every LP kind has benefits and drawbacks of its own. A trader’s own demands and tastes will determine the ideal LP for them.

Due to their better quality of service and generally greater experience, banks may be preferred by some traders as their LPs. These dealers, however, could be prepared to pay a greater price for these services.

Due to the fact that they are often more ready to take risks, some traders could prefer having non-banks as their LPs.

The fact that these suppliers could not have the same degree of expertise or money as banks, though, is something that these traders may need to be cautious of.

It’s also important to keep in mind that certain dealers could mix bank and non-bank LPs.

This can guarantee that they have access to a wider variety of LPs and can make the most of both types.

Verdict

LPs’ function has evolved greatly throughout time. FX liquidity services were formerly solely offered by banks, which generally catered to big institutions. However, non-banks have been more active in the market recently and offer liquidity to many dealers.

Future developments in the role of LPs are probably coming. New participant types will probably appear as the market develops, and liquidity provision is likely to vary.