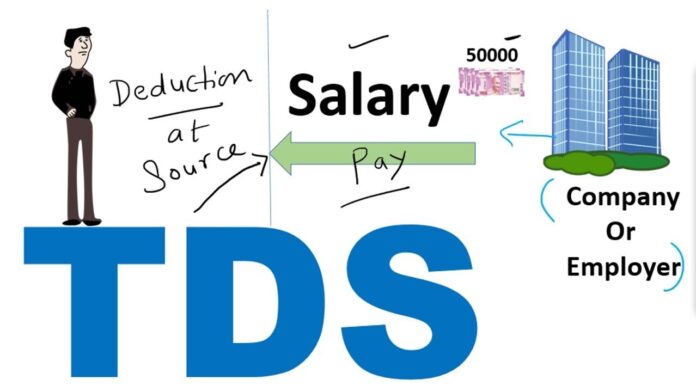

Taxes that you pay to the government form a major source of revenue for the government but still many people try to evade taxes by different means. To reduce evasion of taxes, the government introduced TDS or Tax deducted at source, which is an advance payment of tax from the source of payment. If you are a salaried employee, you must have seen TDS being deducted from your salary, which is reflected in the salary slip. So, how much TDS is deducted, and when it is deducted, can you claim a refund? Many such questions must be on your mind, isn’t it? This article will help you find those answers.

What is TDS on salary?

As per section 192 of the Income Tax Act, 1961, Tax deducted at source means the person/entity/organization making payment to employee/professional/ individuals and others can deduct tax before making such payments. TDS on salary is the tax that your employer deducts if your salary exceeds the threshold set by the government for deducting TDS. The employer deducts the tax and deposits the same with the government. Employers are bound to deduct TDS as per the rule of the government and the IT Act. However, if your total tax liability is less than the tax deducted, you will be eligible to claim and get a refund of the TDS on your salary.

Who is eligible to deduct TDS?

If you are working with any private or public company, HUF, individuals, trusts, partnership firm, or co-operative societies, then the employer can deduct TDS on salary. If there is an employer-employee relationship and the employer pays salary to the employee, then the employer has to deduct TDS if the salary of the employee surpasses the threshold limit.

Thus, TDS on your salary can be deducted by any of the following:

- Any private or public limited company

- HUF (Hindu Undivided Family)

- Proprietorship company

- Any partnership company or Limited Liability Partnership Firm (LLP)

- Individuals

- Trust, co-operative societies, charitable organizations, etc.

- Any other organization who is legally bound to deduct TDS.

What is the rate of TDS deducted?

Now, Section 192 of the Income Tax Act does not directly specify the rate of TDS deduction. It depends on the tax slab of the individual. Now, the employer needs to estimate the total annualised income of the individual and then deduct tax accordingly. Basically, the total tax payable for the entire year divided by 12 is the amount of TDS that the employer should deduct on a monthly basis.

Now, if the individual’s PAN number is updated, the employer needs to deduct 20% + 4% cess as TDS. However, if the employee has made any advance tax payment, the same can be adjusted against the TDS deduction. Only the intimation needs to be provided to the employer regarding the advance tax for the adjustment to be done.

When is TDS deducted?

The government has set an exemption limit for the employees for deduction of TDS, this exemption limit is referred to as the threshold in the above paragraph. So, when the employee’s salary exceeds the threshold, the employer deducts TDS. The threshold for deducting TDS on salary is as follows –

- For employees below the age of 60 years – Rs. 2.5 lakhs p.a

- For employees above the age of 60 years but below 80 years – Rs. 3 lakhs p.a

- For employees above the age of 80 years – Rs. 5 lakhs p.a.

What is the due date for depositing TDS?

TDS on salary has to be deposited by the employer with the government by the 7th of the next month. For instance, the TDS deducted for January has to be deposited by the 7th of February. However, for the TDS deducted for March, the due date is 30th April as March is the last month of the financial year. The employer deposits the TDS using the Challan ITNS-281. It is available on the government portal for the submission of taxes.

Things to consider while calculating TDS on salary

Multiple tax exemptions are available to the employees and for the calculation of the TDS, these exemptions are needed to be kept in mind. Here are these exemptions –

- House Rent Allowance: If you live in a rented house, you can get a partial or full exemption for your house rent paid as per HRA rules. The least of the below-mentioned factors will be considered for deduction –

- The actual house rent is paid minus 10% of the basic salary plus Dearness allowance if you have.

- 50% of the basic salary if you are staying in a metropolitan city and 40% if in a non-metro city.

- The actual amount provided as HRA by the employer

- Standard deductions of Rs. 50,000 which includes transport and medical allowances

- Children’s education allowances of Rs. 100 per child for a maximum of 2 children

- Leave travel allowances – least of actual travel cost or LTA allotted in salary. It can be claimed two times within a block of 4 years.

Can I claim a TDS refund?

Yes, you can claim a TDS refund if the amount deducted at the source is over and above your actual tax liability. For claiming a return, you need to file the ITR and along with that, Form 24Q which is for TDS on salary.

TDS Certificates

TDS certificates can be referred to as the acknowledgement documents that your employer has duly deposited the TDS deducted by them with the government. Form 16 is issued by the employer to the employee every year on the 31st of May.

What is the tax liability when TDS is already deducted?

The total tax liability of the employee has to be calculated, then the amount deducted as TDS needs to be subtracted from the same and you can derive the amount you need to pay as taxes. If the total tax liability is less than the TDS on salary, then you will get a refund from the government.

Conclusion

As an employee, you need to be aware of all the details about TDS as it affects your in-hand salary. It is important to duly file ITR and claim a refund on your TDS if any within the stipulated time.

![Anso FG Reviews: UPDATED 2024 [ansofg.com] Anso FG Reviews UPDATED 2024 [ansofg.com]](/wp-content/uploads/2023/12/Anso-FG-Reviews-UPDATED-2024-ansofg.com_-100x70.png)