The actual average range (ATR) is a technical analysis indicator introduced by market technician J. Welles Wilder Jr. in his book New Concepts in Technical Trading Systems that measures market volatility by decomposing an asset’s entire price range.

The accurate range indicator is the greatest: the current high minus the recent low; the absolute value of the recent high minus the previous close; and the total value of the current low minus the previous close. The ATR is then calculated as a 14-day moving average of the actual ranges. Click here to learn about what is auditing.

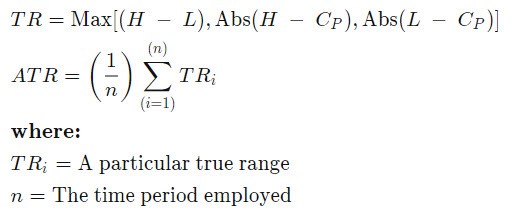

ATR (Average True Range) Formula

The first step in calculating ATR for security is identifying actual range values. An asset’s price range for a given trading day is simply high minus its low. Meanwhile, the existing range is more expansive and is defined as follows:

How to Calculate the Average True Range (ATR)

Traders can use shorter periods than 14 days to generate more trading signals, while more extended periods are more likely to create fewer trading signals.

Assume a short-term trader only wants to look at a stock’s volatility over five trading days. As a result, the trader could compute the five-day ATR. The trader finds the maximum of the absolute value of the current high minus the recent low, the current high minus the previous close, and the total value of the current low minus the previous close, assuming the historical price data is arranged in reverse chronological order. These accurate range calculations are performed for the five most recent trading days and then averaged to calculate the first value of the five-day ATR.

What Does Average True Range (ATR) Indicate?

Wilder created the ATR for commodities, but it can also be used for stocks and indices.

Market technicians can use the ATR to enter and exit trades. It allows traders to measure an asset’s daily volatility using simple calculations. The indicator does not indicate price direction; it measures volatility caused by gaps and limits up or down moves. The ATR is a simple calculation that requires only historical price data.

The ATR is a popular exit method that can be used regardless of entry decisions. Chuck LeBeau invented the “chandelier exit.” The chandelier exit places a trailing stop below the stock’s highest high since you entered the trade. The distance between the highest and the stop level is expressed as a multiple of the ATR.

The ATR can also tell a trader what size trade to place in the derivatives market. The ATR approach to position sizing can account for an individual trader’s willingness to accept risk and the volatility of the underlying market.

The Average True Range’s Limitations (ATR)

The ATR indicator is a subjective measure, meaning it can be interpreted differently. No single ATR value can tell you whether or not a trend is about to reverse. Instead, ATR readings should be compared to previous tasks.

Second, ATR only measures volatility, not the price direction of an asset. This can sometimes result in mixed signals. What is a trial balance? Click here to know more.

![Anso FG Reviews: UPDATED 2024 [ansofg.com] Anso FG Reviews UPDATED 2024 [ansofg.com]](/wp-content/uploads/2023/12/Anso-FG-Reviews-UPDATED-2024-ansofg.com_-218x150.png)

![Anso FG Reviews: UPDATED 2024 [ansofg.com] Anso FG Reviews UPDATED 2024 [ansofg.com]](/wp-content/uploads/2023/12/Anso-FG-Reviews-UPDATED-2024-ansofg.com_-100x70.png)